On Monday, February 16, 2026, the United States observed Presidents Day, a longstanding federal holiday that significantly influenced government operations, financial markets, and consumer behavior across the nation. As one of the earliest major calendar events of the year, Presidents Day serves not only as a tribute to the legacy of American presidential leadership but also as a measurable economic and cultural milestone in the national business cycle.

What Presidents Day Means in 2026

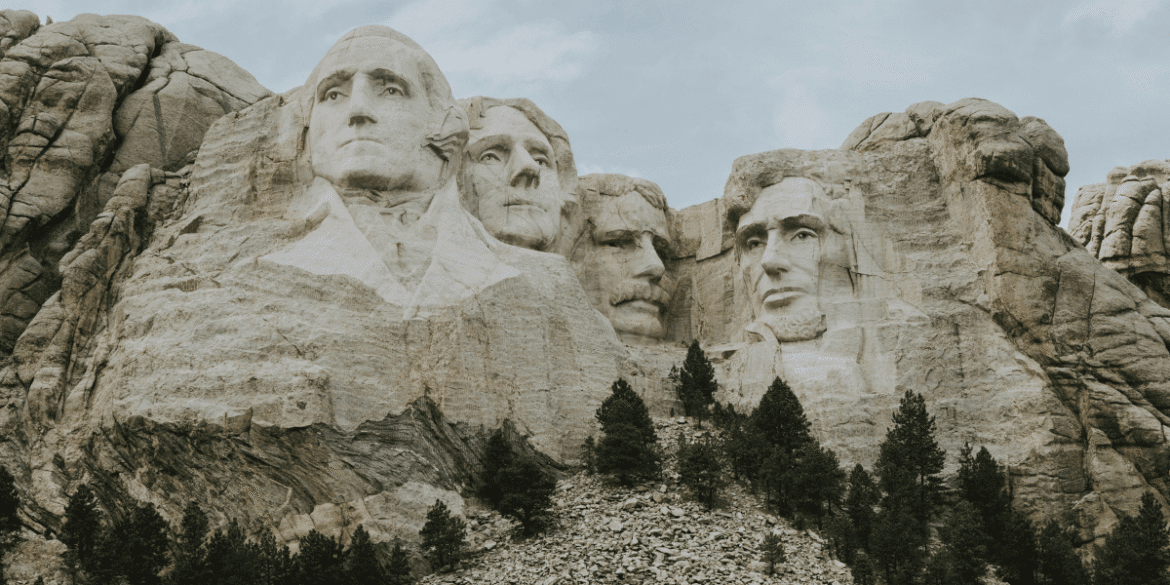

Presidents Day, officially designated on the third Monday in February, originated as a commemoration of George Washington’s birthday. Over time, the holiday has evolved into a broader observance of U.S. presidential leadership and a symbolic pause in the federal calendar. In 2026, it falls on February 16, continuing a tradition that balances civic remembrance with practical pauses in economic and institutional activities.

For businesses, executives, and investors, understanding the timing and implications of Presidents Day is essential for strategic planning, especially given its impact on markets, staffing, consumer behavior, and operational logistics.

Closures and Market Impacts

On February 16, federal and many state government offices were closed in observance of the holiday. This encompassed the U.S. Postal Service (USPS), which suspended all delivery and retail services for the day, and most federal courts and administrative offices.

Financial markets in the United States were also affected. Major exchanges including the New York Stock Exchange (NYSE), Nasdaq, and the bond markets paused trading for the holiday, marking one of the scheduled market holidays in 2026. This temporary cessation offers investors and market participants a predictable break in trading activity, which can influence liquidity and planning around portfolio adjustments.

Banks and other financial institutions followed the Federal Reserve’s holiday calendar, leading to widespread branch closures. While online and mobile banking services remained accessible for routine transactions, in-person services were unavailable for most customers.

These closures have clear implications for executives involved in financial operations, corporate treasury functions, and cash management, requiring proactive planning around payment processing and liquidity needs during the federal holiday.

Retail and Consumer Behavior: A Strategic Opportunity

While government and financial institutions paused operations, private-sector businesses and retailers largely remained open. Presidents Day has become a significant retail event, with many companies leveraging the long weekend to drive sales and boost quarterly performance metrics.

Retailers across sectors, from big-box stores to online marketplaces, capitalized on the holiday by offering substantial discounts on electronics, furniture, apparel, and home goods. Such sales efforts help stimulate consumer spending during winter months and can serve as momentum builders leading into the spring selling season.

For executives in retail strategy and marketing, Presidents Day is a predictable anchor for promotional planning. Many businesses begin strategizing early in the fiscal year to align inventory, advertising spend, and pricing strategies with anticipated holiday demand, aiming to increase foot traffic, convert long-weekend shoppers, and manage inventory turnover.

Broader Economic and Cultural Significance

In addition to its economic impacts, Presidents Day carries cultural and institutional significance. Schools, particularly at the public level, often close for the holiday, affecting workforce planning for families and employers alike. National parks and certain public venues offered free access or special programming, further engaging consumer and tourist activity.

A 2025 study into holiday market effects found that federal holidays like Presidents Day can correlate with higher pre-holiday stock returns, reflecting seasonal sentiment and market psychology. While not a trading strategy, these patterns underscore how predictable calendar events intersect with investor behavior.

Key Takeaways for Business Leaders

- Operational Planning: Recognize federal holiday schedules well in advance to avoid disruptions in financial operations, logistics, customer service, and supply chain activities.

- Market Awareness: Plan around stock market closures, particularly for activities tied to trading, settlement cycles, and capital markets engagement.

- Retail Strategy: Leverage the holiday’s consumer engagement potential with thoughtful promotions that align with broader Q1 objectives.

- Workforce Considerations: Account for holiday-related absences in staffing, client service availability, and internal workflows.

In sum, Presidents Day 2026 exemplifies how a historic observance continues to shape contemporary business dynamics. By understanding its multifaceted implications, spanning market closures, retail opportunities, and broader economic rhythms, executives and professionals can better align strategy with real-world calendar events that influence the U.S. economy.