London accountant combines strategy, empathy, and constant communication to guide founders in cash flow and growth.

In 2014, during a CIMA training course, Imran Hussain heard a lecturer describe how artificial intelligence could automate much of professional work within two decades. For someone with over a decade of technical accounting experience, the message felt personal. The question was not whether technology would change the profession, but what would remain when it did. That evening, Imran realized the future would always need human connection.

This insight became the foundation of Imran’s approach to financial advisory. Today, he serves as a Fractional CFO and business advisor, combining technical expertise with proactive communication and empathy. His approach goes beyond spreadsheets: he operates as a strategic partner, helping entrepreneurs navigate cash flow, decision fatigue, and the isolation that often accompanies business ownership.

Imran began his career in 2001, developing a strong technical foundation in accounting. For years, he focused on accuracy, compliance, and steady improvement. But the 2014 realization prompted him to expand his value beyond technical skill. If machines could process data, people would need advisors who could listen, explain clearly, and respond consistently.

To strengthen this human side, Imran explored storytelling, improv, acting, creative writing, and even clowning – not for performance, but to learn how to read a room, communicate under pressure, and connect with decision-makers. In startups and small businesses, these interpersonal skills can be as critical as technical accuracy.

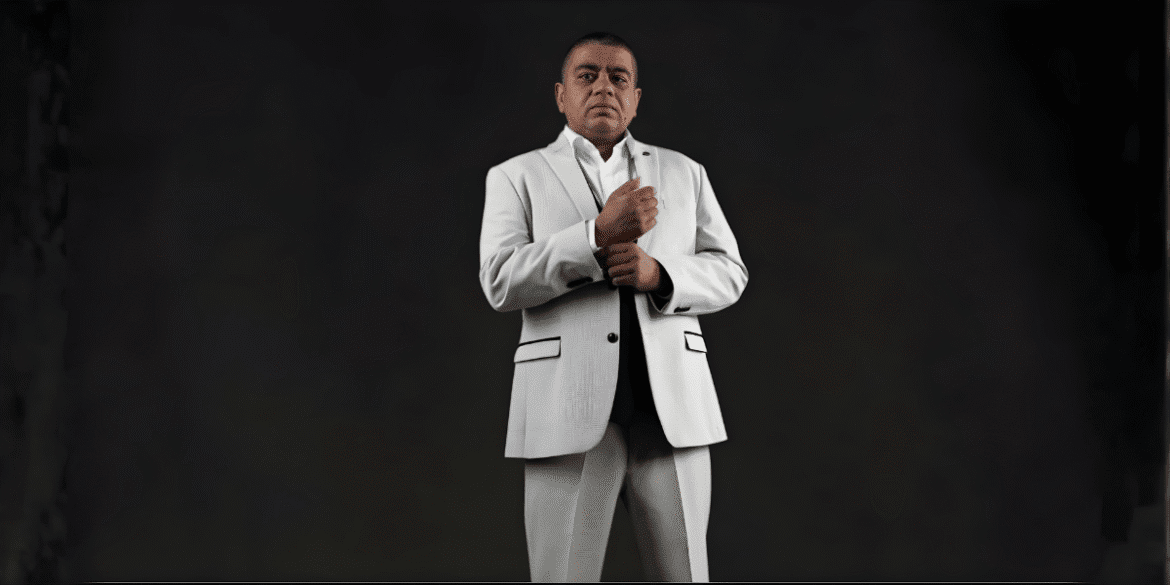

Recently, Imran Hussain received the prestigious title of Best Fractional CFO in London of 2026 by Best of Best Review. This award recognizes his unique blend of financial expertise and personal service, highlighting his commitment to helping entrepreneurs succeed. Imran’s dedication to staying ahead of the curve – combining technology with human insight – has set him apart as a forward-thinking leader in the field.

Imran’s practice emphasizes availability and trust. He gives clients his mobile number and remains reachable from early morning to evening, including weekends. By limiting the number of clients he accepts, he ensures each one receives consistent attention. He identifies issues before they escalate and addresses conversations that founders often avoid. “If I take on a client, it is my duty to outservice the competition: to be in constant communication, responsive, and honest,” he says.

Many of his clients operate under tight cash flow or during periods of loss. Imran treats these realities with clarity and calm, focusing on steady progress rather than promises of rapid transformation. “I have spent many years working with businesses with tight cash flows and often making a loss. Nothing fazes me, and I enjoy helping entrepreneurs turn around their businesses,” he explains.

What sets Imran apart is the structure of his service. He deliberately stays small to remain personal. “I limit the number of clients I take onboard to ensure I deliver a high level of service to each client,” he says. In a market that often prioritizes volume, his metric of success is depth of relationship.

Clients notice the difference. Katinka Nordenskiöld, a long-term client, describes a fully online relationship grounded in trust: “Imran has supported my organisation for almost five years, helping with filings and advising on accounting practices. He is thoughtful, service-minded, proactive, and responsive. I highly recommend him.”

For founders who do not require a full-time CFO, Imran offers senior-level financial guidance without the overhead. He translates data into actionable decisions, risk into planning, and uncertainty into manageable steps. His early warning about automation did not push him out of accounting; it pushed him deeper into its human layer.

Based in London, Imran works with entrepreneurs in one of Europe’s most dynamic startup ecosystems. Speed and adaptability are critical, and his insistence on daily communication provides clients with the clarity and confidence they need.

The story of Imran Hussain is not about resisting technology; it’s about choosing where human effort adds the most value. Automation can process data, but it cannot replace the reassurance of a calm voice when cash is tight or the clarity of a conversation that turns fear into a plan. By centering his practice on connection, responsiveness, and honesty, Imran has built a model that reflects the realities of modern entrepreneurship.

Imran’s online presence reflects the same clarity and accessibility. His website outlines services in plain language, while his professional insights can be found across social platforms: Instagram, X, Facebook, and LinkedIn. Trust often begins with recognition, and these profiles, along with professional portraits, reinforce the personal connection he builds with clients.

For founders tired of feeling like a file number, the appeal is simple: an advisor who answers, explains, and remains present when decisions get hard. That focus defines Imran and ensures his work continues to resonate over two decades into his career.

For more about Imran’s services, visit Imran Hussain Fractional CFO.